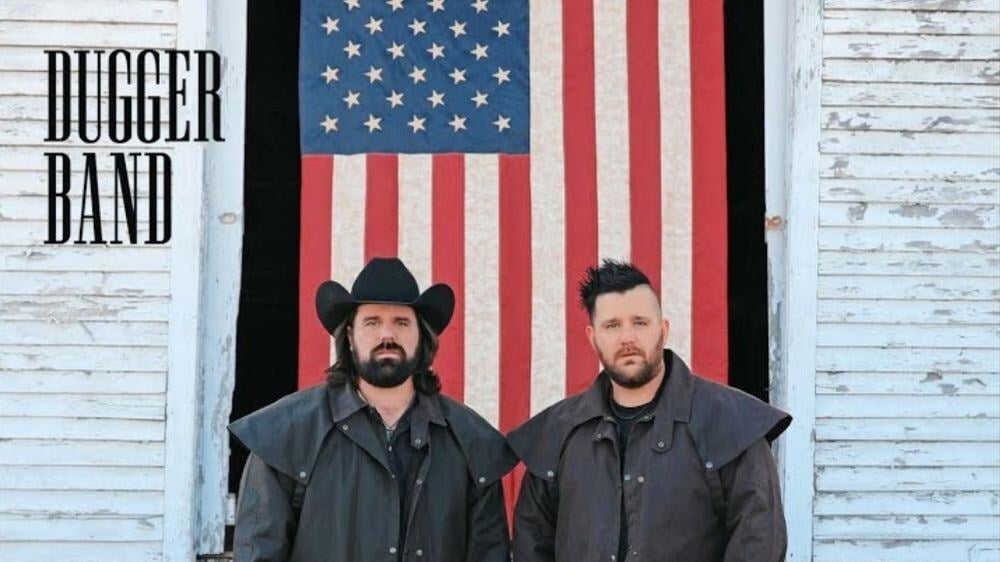

Unlike the Dugger Brothers and Old Glory Bank, They Aren’t Red, White, and Blue.

TV Station WSMV in Nashville, Tennessee, has backtracked on its invitation to country music duo Dugger Band to play their song “True Colors” on the air, deeming the song too political for their morning programming. It seems freedom of speech is not a value this supposedly unbiased news station supports.

John and Seth Dugger, the brothers who form Dugger Band, are friends of Old Glory Bank. Their song was produced by our co-founder, John Rich, and is an anthem of everything Old Glory Bank stands for – love for our country, for freedom, for American heritage, and for Old Glory herself.

The chorus of the song proclaims,

“But I ain't leaving here

I'm an eighth generation

God-fearing, blue collar with the flag waving

And I don't wait for the Fourth of July

It′s year round lifelong American pride

And right here, right now, I'm drawing the line

If this country ain't something you can stand bеhind

Then that's the differеnce 'tween me and you

'Cause my true colors are red, white and blue”

The station sent an email on Tuesday, March 11, one day before Dugger Band’s scheduled appearance on Today in Nashville, stating that the song’s lyrics, “cross a political line that we as a station cannot cross.” They offered to let the band play a different song during their appearance, which the Dugger brothers declined. They state, “We decided not to perform a different song on WSMV, because our freedom of speech is worth more than their publicity.”

Old Glory Bank co-founder and country artist John Rich, producer of “True Colors,” took to X to comment on the TV station’s decision. He says in his video, “Can you even believe this is still going on? This is still happening. You write a pro-America song, and they’re trying to cancel you. They’re trying to censor you and shut you down. A hundred percent. How do we respond to that, country music fans? All the people that follow me and all the rest of the conservative folks on X? How do we respond to that? I know one way. Download their song. … How about we send them to the top of the download charts one time? … This is important. The culture war continues, and we cannot let them get away with this.”

Old Glory Bank is founded on the pro-America values that WSMV seems to find offensive – the freedoms bestowed upon every citizen by the Constitution and the First Amendment. We stand with Dugger Band in their right to perform “True Colors” without censorship. We are proud to be Red, White, and Blue.

We call on Old Glory Nation to support Dugger Band by sharing John Rich’s post, and by downloading their song. The war against cancel-culture is far from over. We’re proud to be fighting as the bank for the Freedom Economy and for patriots who proudly love the U.S.A.